It is rather common to hear or read in popular media that only 1% of Indian population pays income tax. The Economic Survey 2017-18, corrects this misinformation and puts the number of income tax payers at 5.9 crore people or 4.5% of total population. While certainly higher than the earlier claim of 1%, the number 4.5% is still very small; and it seems like the remaining 95% of Indians are not paying income tax. However, it should be noted that expressing the number of tax payers as percentage of population gives an inflated sense of large number of tax evaders, because the population also includes many groups which are not required to pay income tax ; like children, students, those with income below the exemption limit, or those earning income from agriculture. To find out how many Indians are evading income tax, i.e. – those who should be paying income tax but are not, it is required first that we have some estimate of how many people in India should actually pay income tax, in other words – what is the income tax base of the country.

This article is an attempt to find such an appropriate base, which can approximate the number of potential income tax payers. The approach chosen is that we eliminate particular groups of population which are not required or expected to pay income tax. Thus, whatever is left finally will be the number of tax payers who should pay income tax. The year chosen for estimation is 2014-15, mainly because of data availability.

It would be helpful to highlight here that who all are required by law to pay income tax in India. The legal definition is much more elaborate and complex, but for our purpose, it can be said that all Indian citizens living in India and earning more than Rs 2.5 lakh per year, excluding income from agriculture, are required to pay income tax.

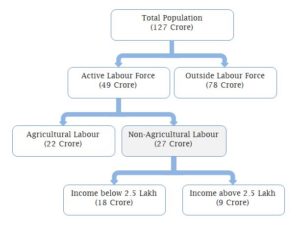

Out of the total population, those below the age 18 can be excluded straightaway as they are not expected to earn income. And, while it is possible that some below this age are working, their number would be much smaller, not to mention that the income will be below the taxable limit. A related approach is to take the number of voters as the potential tax base. By this approach, the potential tax base in India should be close to 83 crore. However, there are many groups within voters which are not expected to pay income tax, for example those who are still studying, those who are too old to work, or those who are not working for other reasons. The very low participation rate of women in work force in India, at just over 25%, means remaining 75% are not earning and hence excluded from being a potential income tax payer. Cases like these can be accounted for if instead of number of voters, the active labour force is taken as the income earners and hence potential tax base. The active labour force in India is estimated at around 49 crore. Two groups that need to be excluded from this are – those earning their income from agriculture as agriculture income is tax exempt, and those whose income is below the taxable limit, i.e. Rs 2.5 lakh per year. Proportion of labour employed in agriculture is estimated around 45% of total labour force, which translates to around 22 crore workers. Removing this group leaves 27 crore of labour force in non-agricultural activities. Within this group, those having income above 2.5 lakh should pay income tax while those below are not expected to.

To estimate, what proportion of income earners are above that limit, the income distribution data for India is needed, which to the best knowledge of author, is not available. The data released by income tax department based on the income tax returns filed gives one income distribution. As per this data, out of total 4.07 crore individuals who filed tax return, 3.25 crore or 80 percent showed income above Rs. 2.5 lakh, while 82 lakh or 20 percent showed income below the threshold level. Based on this income distribution, the income tax base should be 21-22 crore. Although, it can be argued that this is overestimation because the average income of people filing tax returns, at Rs 5.2 lakh per year, is likely to be much higher than those not filing tax returns.

An indirect method to account for this could be looking at the National Accounts Statistics. The national accounts statistics puts the countrywide aggregate personal income for 2014-15 at Rs. 96 lakh crore, while the share of agriculture in national income was at Rs. 20 lakh crore, leaving around Rs 76 lakh crore for non-agricultural personal income. From above numbers, the average personal income for non-agricultural labour force can be calculated as Rs 2.83 lakh per year.

Combining the above average income (Rs 2.83 lakh) from national accounts statistics with the income distribution from income tax return data, we get income tax base as 34% of non-agricultural work force, which translates to 9 crore of tax payers.

At less than 10% of population, this seems like a large underestimation and there is a possibility of underestimation to some extent. However, considering the fact that only 27 crore individuals (21% of population) are earning income from non-agricultural sources, with large number of them having income less than the taxable threshold of Rs 2.5 lakh, this number might not be too different from actual income tax base of the India.

The estimation carried out above is rather simple, and doesn’t take into account many important factors. For example – instead of active labour force, perhaps a better indicator of income earners would be number of employed people. Similarly, there are people outside active labour force, who could still be earning passive income, such as from rent, interest, or dividend. It also doesn’t include the retirees with pension, who for central government alone number around 52 lakh, and there could be many more for state governments. Another, potential big source of underestimation could be national accounts statistics, which, due to presence of large black economy, grossly underestimates national income. And, there would be underreporting of income in the tax return. Notwithstanding these weaknesses, till a more detailed estimation is available, accounting for all these factors, current estimation of tax base as 9 crore tax payers is a much better indicator of potential tax base than the other regularly used like the population, or the number of voters.

It should be noted here that above estimation only focuses on one aspect of tax evasion, i.e. - when someone who should be paying tax but is not. Another important aspect is when someone pays tax, but less than what is due. For example – someone with income of Rs 20 lakh, reporting income as Rs 5 lakh only and paying tax on this underreported income. A comprehensive analysis of tax evasion requires consideration of this aspect as well.

The views expressed in this piece are those of the author, and do not necessarily reflect the position of CBGA. You can reach Suraj Jaiswal at

su***@cb*******.org

.

29 August 2018

29 August 2018

Will the income tax percentage come down drastically if all liable Indians pay it

It may not come down drastically. But it can definitely reduce to about 25% as the marginal rate instead of the present 30%. Also, the tax slabs can become wider so that much larger income is taxed at the lower rates and the effective tax for an individual can reduce.