Taxes are the biggest source of revenue for the Indian government. In 2017-18, the latest year for which the centre and states combined data is available, out of the combined centre-state estimated expenditure of Rs. 48.6 lakh crore, about Rs. 30 lakh crore (62 percent) was to be financed through tax revenue. And, out of all tax revenue that Indian governments (centre and state combined) are able to raise, about 63-64 percent comes from the central taxes.

Central taxes, apart from a few exceptions like cesses and surcharges, form the basis of divisible pool of taxes; revenue from which is shared between the central government and the states government. As such, revenue raised from the central taxes not only determines the capacity of the central government to finance its own programmes, but it is also crucial for the state governments to be able to finance their own programmes. Moreover, the tax revenue raised can provide the government resources to deal with the macroeconomic issues such as the ongoing economic slowdown or high unemployment. Because of these reasons, tax revenue numbers presented in the Union Budgets are always anticipated with great interest.

The Tax revenue numbers given in the Union Budgets, however, are not straight forward, and to understand it completely requires understanding the three different types of tax revenue numbers given in the budget, namely budget estimates (BE), revised estimates (RE), and actual collection (AC). BE numbers tell how much tax revenue the government expects to collect in the coming year, and they are estimated before the start of financial year. RE numbers tell how much revenue the government expects to collect in the ongoing financial year, and they are estimated during the year taking into account the revenue collected in the months that have already passed. The AC numbers tell how much tax revenue was actually collected in the year, and they become available only when the year is complete. For example, if one wants to understand the tax revenue for FY 2020-21, the Union Budget 2020-21 only gave the BE numbers, the RE numbers will be available in the next budget, i.e. – 2021-22, and the actual collection will be known only in the budget 2022-23. The distinction between these numbers is essential prerequisite to understand the tax revenue numbers in the budget.

According to the union budget 2020-21, the government expects central tax revenue for the coming financial year (FY 2020-21) to be Rs. 24.23 lakh crore. However, the budget also notes that the revised estimate for tax revenue collection for FY 2019-20 is Rs. 21.6 lakh crores against the budget estimates of Rs. 24.6 lakh crore – a shortfall of Rs. 3 lakh crores, or about 12 percent. This confirmation about less than estimated tax revenue collection has been manifesting in various forms over the last few months, such as spending cuts to curb deficit, non-payment or delayed payment by the government, higher borrowing than estimated, and lower transfer to states.

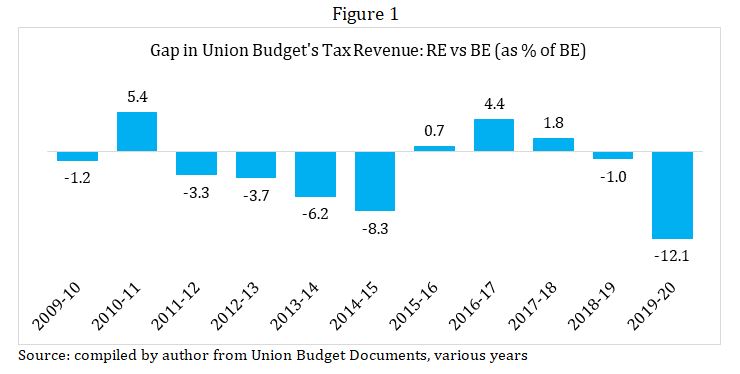

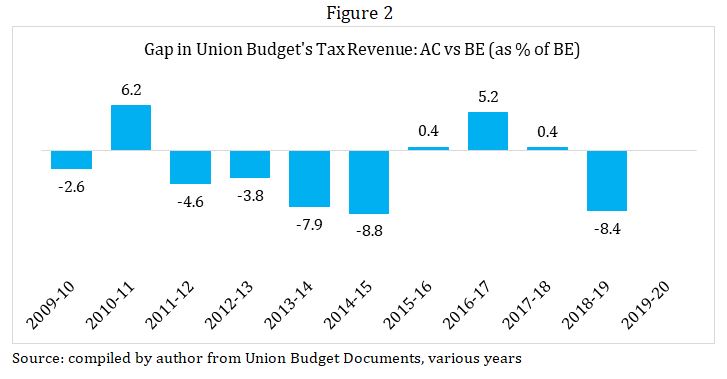

Such mismatch between budget estimates and revised estimates / actual collections are not necessarily a new phenomenon, as can be seen from the figure 1 and 2, which depict the gap between BE and RE/AC of the tax revenue in the Union Budget for the last 10 years. Negative numbers in the following figure indicate that RE/AC numbers were lower than BE, and vice versa.

Essentially, budget estimates of revenue collection are expectations about future, and there are number of factors that can affect the tax collection, such as economic growth and international trade. Some occasional random events such as drastic fall in the international price of crude oil can also affect the tax collection as it happened in 2015-16 and 2016-17, when the Union Government increased the taxes on petroleum products and received a windfall revenue gain. This large gain in tax revenue resulted in actual collection being higher than estimates. Because of variations in the factors which determine the tax collection, certain degree of deviation in actual tax revenue from budget estimates is to be expected.

However, the last two years are different from previous years on two counts-

1)The gap between revised estimates and actual collection for FY 2018-19 was 7.5 percent; while in the earlier periods, the actual collections have deviated from the revised estimate numbers by the margin of 1.0 to 2.0 percent only.

2)The large gap of 12 percent in 2019-20, even when the budget was presented in June due to general election, as opposed to February in regular years. This late budget provided data for four more months than usual, yet the estimates were off the mark by a wide margin.

Part of the large shortfall in tax revenue in 2019-20 is due to the corporate tax rate cut which was done in September 2019, after the budget was presented in June. However, even the tax base excluding corporate tax has seen the shortfall of more than 8 percent. Some commentators have argued that this increased gap between budget estimates and revised estimates / actual collection could be due to the budget date being shifted from 28th February to 1st of February in 2017-18. Because of this advancement of date, government has to make estimates based on comparatively fewer / older data. However, this can only explain the gap for FY 2018-19, and not for FY 2019-20 when budget was presented in June. Other, more plausible, arguments have been made that the gaps are due to the weakness in methodology used for estimation, and the government not utilising the latest data available for the budget. The point regarding not utilising latest data does seem to be the case, because the numbers presented in the 2019-20 and 2020-21 Union Budgets are certainly not in line with the tax revenue data presented by Controller General of Accounts (CGA), which provides the actual data for government finances up to last month.

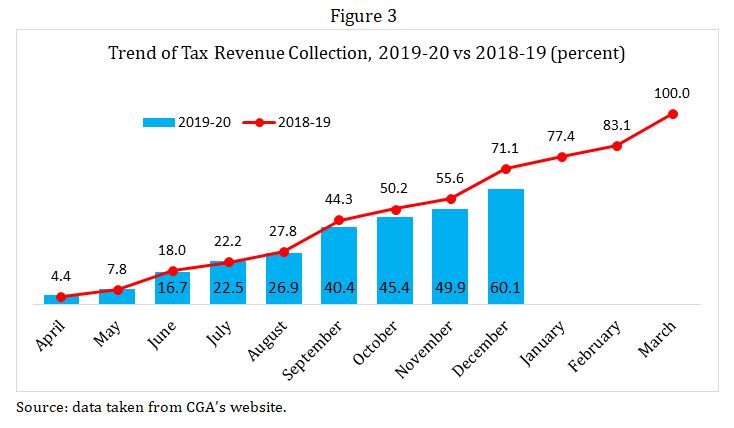

For example, the RE number for FY 2019-20 given in the Union Budget 2020-21 for centre’s share in central tax collection is Rs. 15.0 lakh crore; while according to the CGA’s website, the same tax collection till the end of December 2019 is Rs. 9.0 lakh crore, or only about 60 percent of RE. And, while it is true that January-March quarter sees the highest tax collection, numbers from last year show that till December 2018, 71.1 percent of the revenue was collected (Figure 3).

In fact, the CGA website shows that actual tax collection till December, 2019 is Rs. 9.0 lakh crore compared to Rs. 9.4 lakh crore in same period last year; meaning that the actual tax collections in FY 2019-20 are not only lower than BE and RE, but lower than even the actual collection of the last year. Extrapolating the ratio (tax collected till December/tax collected in full financial year) from FY 2018-29, the centre’s net collection in FY 2019-20 can be expected to be around Rs. 12.7 lakh crore against the revised estimates of Rs. 15.0 lakh crore. And extrapolating the ratio of centre’s net collection to the total central tax collection, gives the central tax collection in FY 2019-20 to be about Rs. 18.3 lakh crore as opposed to the RE of Rs. 21.6 lakh crore.

This essentially means that the actual collection for gross central taxes in FY 2019-20 is likely to fall short of about another Rs. 3 lakh crore or about 14 percent compare to the revised estimates given in the Union Budget 2020-21. And to achieve the BE numbers for FY 2020-21, the central taxes will need an annual growth rate of close to 30%, which based on past numbers is highly unlikely.

A version of this was published in The Wire on February 14, 2020

19 February 2020

19 February 2020