In the interim Budget, the union finance minister Nirmala Sitharaman emphasised the multiplier effect of capital expenditure on economic growth and job creation. The budget for 2024-25 allocates spending at 14.5 percent of GDP, with a significant focus on capital expenditure, which constitutes 23.32 per cent of the total budget, equivalent to 3.39 percent of GDP. This marks a substantial 16.9 per cent increase compared to the revised estimate of the previous fiscal year, reflecting a continued emphasis on capital investments to drive economic growth.

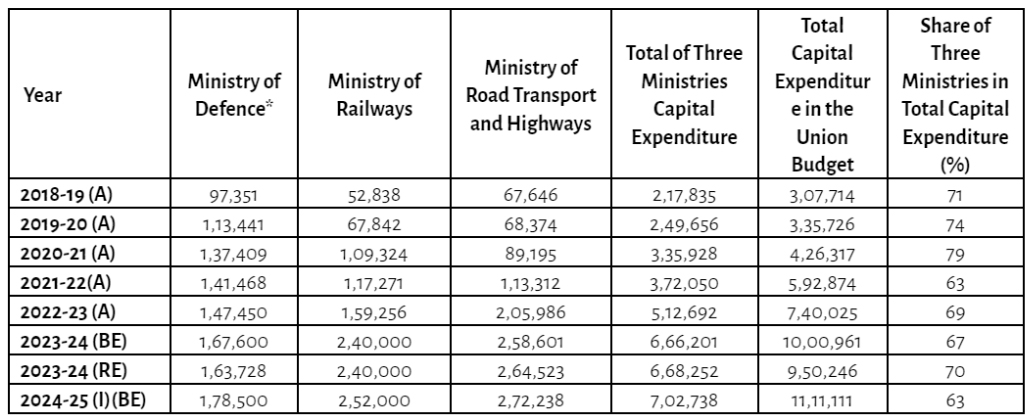

However, a closer analysis reveals that the bulk of this spending is concentrated in three key Ministries – Railways, Road Transport and Highways, and Defence – which collectively represent 63 per cent of the total capital expenditure for 2024-25 (BE). Notably, this share has declined by 7 percentage points compared to the revised estimates of the previous fiscal year (Refer Table 1). In absolute terms, the allocation for these three Ministries has increased though.

Table 1: Key Ministries Appropriating Capital Outlays* (RS. Crore)

Source: Compiled by CBGA from Union Budget Document, various years

*Above calculation for Ministries only account for Capital Outlay under Central Sector Schemes.

The total government expenditure for FY 2024-25 (BE) is projected at Rs 47.65 lakh crore, reflecting a 6.1 per cent increase from the previous year’s Revised Estimates (RE). Within this, revenue expenditure dominates, showing a 3.2 per cent rise over the RE of the previous year. Interest payments constitute a significant portion of the Revenue Budget, estimated at 32.57 per cent up from 29.81 per cent in the FY 2023-24 RE. In line with fiscal consolidation efforts, the Union Government targets a fiscal deficit of 5.1 per cent for FY 2024-25 interim budget Although there has been a notable shift, with the share of the budget allocated to these committed liabilities decreasing from 50.5 percent in FY 2019-20 (BE) to an anticipated 41.9 per cent in the current budget, it still represents a significant portion. This tighter fiscal stance has led to a reduction in the fiscal space for social sector spending.

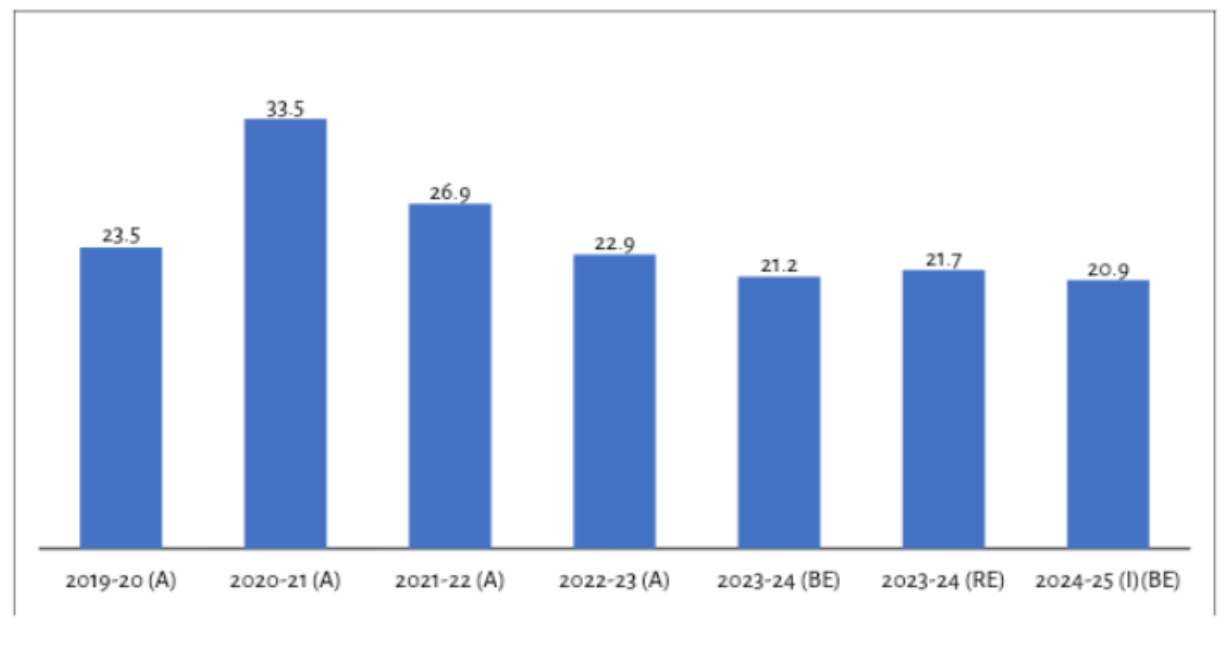

Moreover, a declining trend emerges in the combined budgetary priority for the 16 Union Ministries, broadly considered as the key social sector ministries. The combined allocation for the 16 social sector ministries has declined in the four subsequent Union Budgets, reaching 20.9 per cent in 2024-25 (I)(BE). This is a decline of 0.8 percentage points from that of the revised estimates for FY 2023-24. This trend closely mirrors the reduction in the overall Union Budget’s share of GDP, underscoring a disproportionate impact on social sector ministries.

Combined Share of 16 Social Sector Ministries* in the Union Budget (%)

Source: Compiled by CBGA from Union Budget Documents, various years.

Note: *Ministries of Culture; jal Shakti; Health and Family Welfare (including AYUSH); Education; Labour and Employment; Minority Affairs; Social Justice and Empowerment; Tribal Affairs; Housing and Urban Affairs; Women and Child Development; Youth Affairs and Sports; Agriculture and Farmers Welfare; Environment, Forest and Cliamte Change; Rural Development; Consumer Affaris, Food and Public Distribution (includes food subsidy); and Fisheries, Animal Husbandry and Dairying

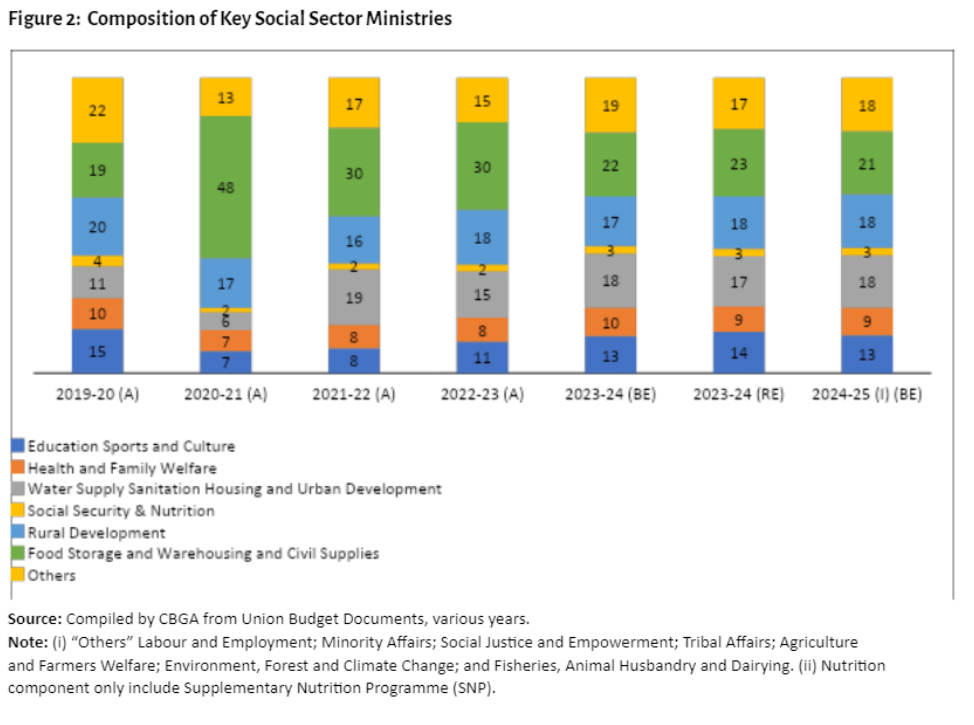

Delving deeper into the allocations within the social sector, we observe a significant reallocation of resources over time. From 2019-20 to 2022-23, the budgetary share dedicated to education, sports, art, and culture diminished from 15 per cent to 11 per cent, although it is projected to recover slightly to 13 per cent in FY 2024-25 BE. However, this remains below pre-pandemic levels. Similarly, the portion of the budget allocated to rural development decreased from 20 per cent in FY 2019-20 to 18 per cent in FY 2022-23, indicating a downward shift even after adjustments for pandemic-related spending increases.

Additionally, despite the critical importance of healthcare during the pandemic, investment in medical and public health declined from 10 percent of the social sector budget in 2019-20 to 8 per cent in FY 2022-23, with a slight improvement to 9 per cent anticipated for 2024-25. This trend is particularly alarming given the increased importance of healthcare infrastructure and services highlighted by the COVID-19 crisis.

The allocation for food subsidies, a vital component of social welfare, notably increased during the pandemic to support the distribution of free food grains. This pushed the share of expenses for food storage, warehousing, and civil supplies from 19 per cent in FY 20192-20 to 30 per cent in 2022-23. Despite this surge, the government’s food subsidy bill is projected to decrease by 3.3 per cent to Rs 2.05 lakh crore for FY 2024-25, from the revised estimate of Rs 2.12 lakh crore for 2023-24. Even as it constitutes the largest portion of social sector spending, this has been declining and is estimated to be 21 per cent in FY 2024-25. As food subsidies directly impact the poor, it is important to reassess budgetary priority to food subsidies, as it would not only raise the purchasing power of the poor but also have broader socioeconomic implications.

The analysis underscores a pivotal issue to the necessity to balance the boost in capital expenditure, vital for economic growth and job creation, with sufficient funding for the social sector. The decrease in allocations for social sector ministries challenges sustainable economic development and the government’s capacity to enhance social welfare.

It’s imperative for policymakers to consider these budgetary priorities’ long-term effects, ensuring that investments in physical infrastructure are matched with investments in social infrastructure. This approach promotes a holistic development strategy, crucial for a resilient and inclusive society, especially as we navigate the recovery from the pandemic’s impacts. The reduction in spending on education, health, and rural development underscores the urgent need for a balanced fiscal plan that adequately supports the social sector’s critical needs alongside capital expenditure.

26 February 2024

26 February 2024