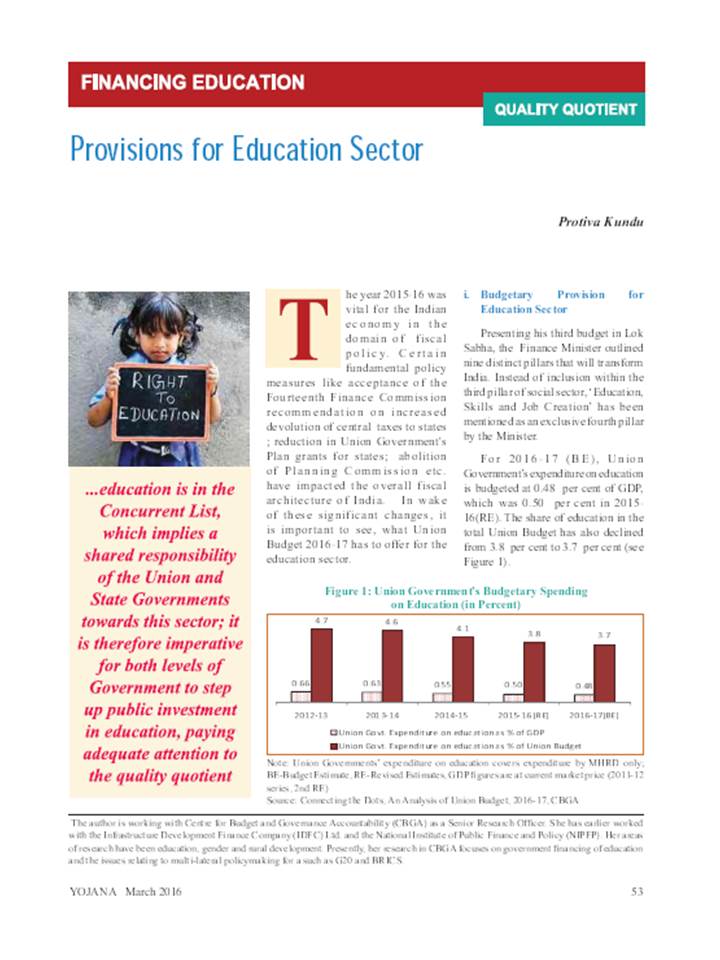

Resource Mobilisation: Did Union Budget Get it Right?

The tax proposals in the Union Budget 2014-15 have been seen as investor friendly with a focus on addressing the increasing tax disputes towards intent to provide a stable tax regime. The retention of retrospective amendments and the surcharge on income tax for the super-rich are welcome proposals in augmenting revenues. The authors suggest additional efforts towards raising revenues through direct taxes such as property taxes (inheritance tax, wealth tax etc) could be considered by the government. There is a need to review exemptions in the Central government tax system (5 per cent of GDP in 2013-14), as recommended by the Economic Survey 2013-14 as well.