Union budget for FY 2021-22 was presented on 1st February. This budget gave the budget estimates for the coming financial year – 2021-22, revised estimates for the ongoing financial year – 2020-21, and the actual numbers for the completed financial year – 2019-20.

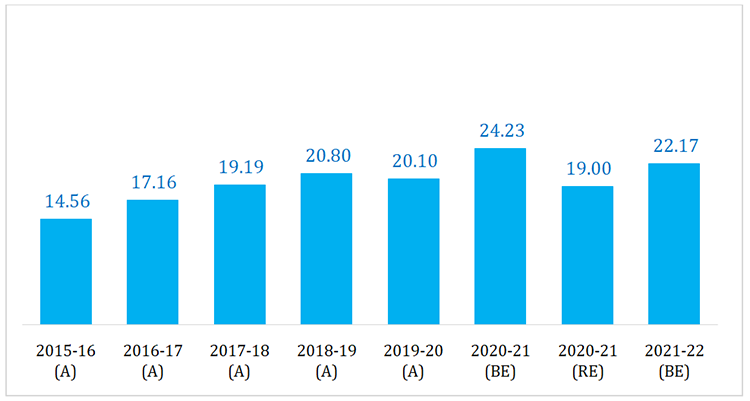

Given that the last budget was presented before the COVID pandemic hit the economy, it was natural that the revised numbers for the ongoing financial year, i.e. – 2020-21, will be much different from the last year’s budget estimates. This is certainly the case for central tax revenue, which, as seen in figure 1, was revised downwards by 22 per cent.

Figure 1: Total Central Tax Collection (Rs. Lakh Crore)

This downward revision, however, does not seem in line with the trend of actual tax collectionin 2020-21.

Controller General of Accounts (CGA) provides monthly data for tax collection. Though provisional, this data is based on actual tax collection, and hence most up to date and accurate data.

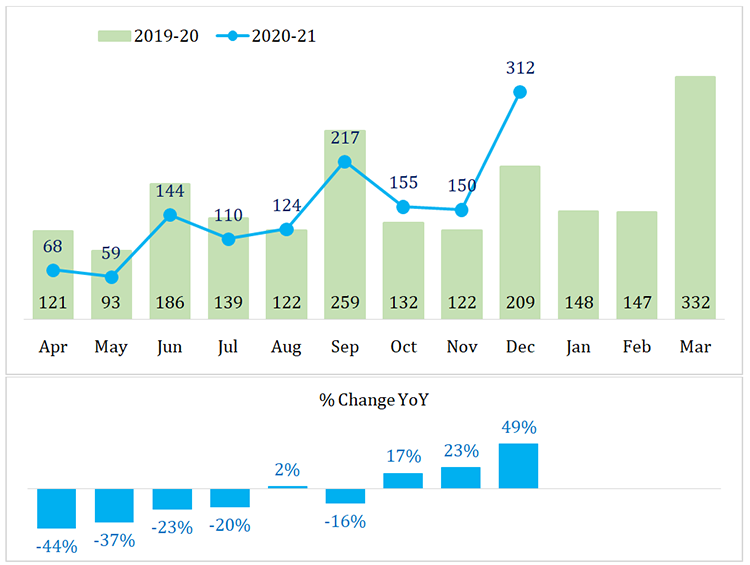

As of 15th February, the data is available for December, 2020. Same data is presented in Figure 2, along with the data for FY 2019-20.

Figure 2: Monthly Tax Collection (Rs. Thousand Crore)

Monthly tax collection in FY 2020-21 was lower than the collection for corresponding months in 2019-20 till September, barring in August where it was marginally higher. By the end of September, the cumulative yearly collection in FY 2020-21 was Rs. 7.2 lakh crore, compared to Rs. 9.2 lakh crore for the same period in FY 2019-20.

Trend of tax collection in FY 2020-21, however, has changed from October onwards. The monthly collections in October, November and December have beenhigher than the corresponding months in 2019-20. Total collection in these three months is Rs. 6.1 lakh crore compared to Rs. 4.6 lakh crorelast year.As of result of higher collection in Q3, the cumulative yearly collection at the end of December isonly three per cent lower, which was 22 per cent lower at the end of September. In other words, the tax collection in FY 2020-21 is catching up fast with last year’s collection, after trailing in first six months.

Based on the revised estimates, the government expects the tax collection in Jan-Mar, 2021 to be Rs. 5.6 lakh crore, while the collection for same period in last year was Rs. 6.3 lakh crore.

What is not clear is, as to why should the collection in Q4 be lower by 10 per cent on YoY basis, when Q3 has seen a growth of 33 per cent.Given the growth trend in Q3, the collection in Q4 is likely togrow, and not contract as suggested by the budget estimates.

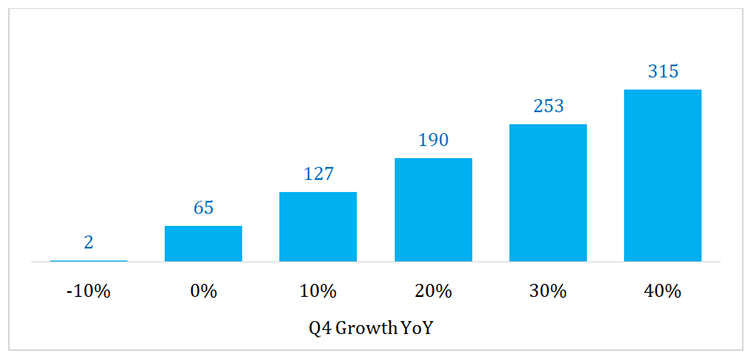

The Figure 3 presents a fewdifferent scenarios of what the level of underestimation will be for a given level of YoY growth rate of Q4 tax collection. In other words, if tax collection in Q4 grows at x per cent, how much is the underestimation of tax collection in absolute amount.

Figure 3: Level of Underestimation for a Given Q4 Growth (Rs. Thousand Crore)

If the Q4 collection contracts by 10 per cent on YoY basis, the underestimation is negligible,only Rs. 2 thousandcrore. In fact, the budget seems to be assuming this scenario.In case of zero YoY growth in Q4, the revised tax collection for FY 2020-21 in budget is still underestimated by Rs. 65 thousandcrore.

If the normal trend continues, i.e. –another lockdown or other such serious scenarios don’t occur,then the most likely case, in author’s opinion, is a growth around 10 to 20 per cent, which will translate into an underestimation of Rs. 1.3 to 1.9 lakh crore.

In recent years, the government has, often,overestimated the tax collections; while this year, it is going in the opposite direction. One serious implication of this underestimation is that the government is spending less than the resources at its disposal,when there is an acute need to adopt an expansionary fiscal policy and increase public spending in order to limit the adverse impacts of pandemic across different sectors.

15 February 2021

15 February 2021